Market Survey: Western Market Share

A Look at Roofing Products in the West

by Marc Dodson, editor

It’s been said before that the roofing industry is fairly constant. Unlike many other construction trades that focus almost exclusively on new construction, people will always need to repair or replace the roof over their heads. With the prospect of a possible downturn in the economy on everyone’s mind, reroofing and roofing repair will still be a much-needed skill.

Our annual reader survey of product market share indicates that while Western roofing contractors are cautious, they are still optimistic about the immediate future. The market share of the individual products shows a slight increase in goods designed for the reroofing market.

COVID-19 made a huge change in workforce habits. About 67% of home-based workers stated they would rather not return to an office environment, and 40% of those stated they would switch jobs if required to go back to the office. Ever since computers became common in the home, working remotely has been discussed. Now it has become a reality.

Remodeling, improving, and expanding the home office has turned into big business and Western roofing contractors are taking advantage of the situation where they can. Unfortunately, material shortages, rising prices, lack of employees, and now mounting interest rates aren’t helping matters. The Associated General Contractors of America recently reported that only 22 states increased the number of construction projects the last few months. Luckily, most of these states are in the West.

Steep-Slope & Low-Slope

As mentioned, reroofing will again make up the majority of the steep-slope market this year. While the housing market is flat in some areas and mortgage rates are on the rise, sales of existing homes across most of the West continues at a brisk, if at a slightly slower pace.

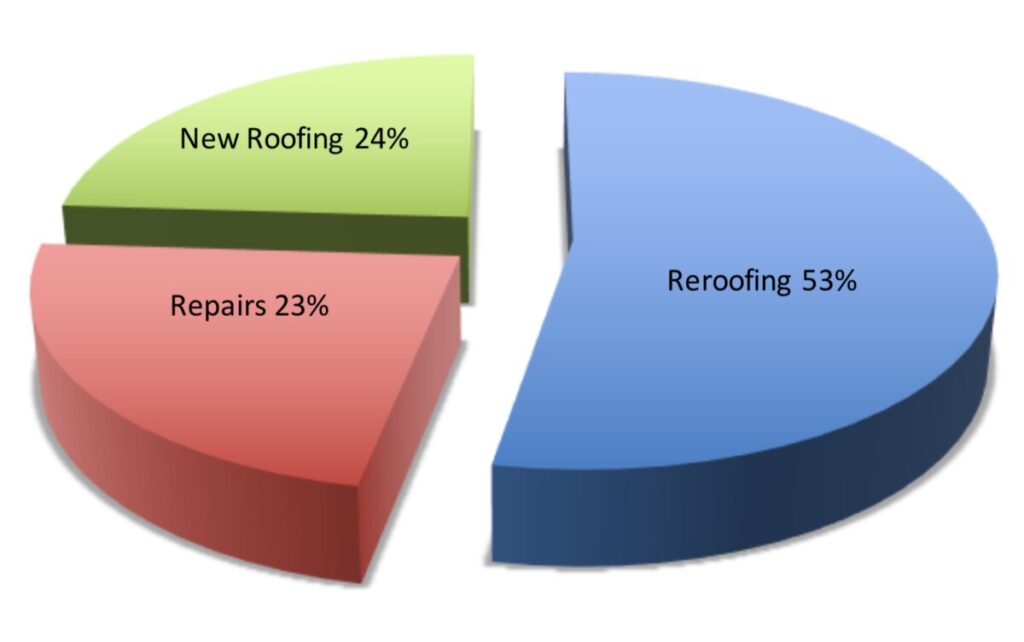

2022 Projected Western Market Mix

Whereas new low-slope construction is slowing, reroofing and recover will account for the majority of growth this year. The low-slope market is expected to capture about 56% of the total this year with steep-slope taking about 44%, a slight decrease for the low-slope portion of the pie. Overall, the projected 2022 market is 24% for new construction, 53% for reroofing, and 23% for repairs and maintenance. New construction dropped a few percentage points this past year.

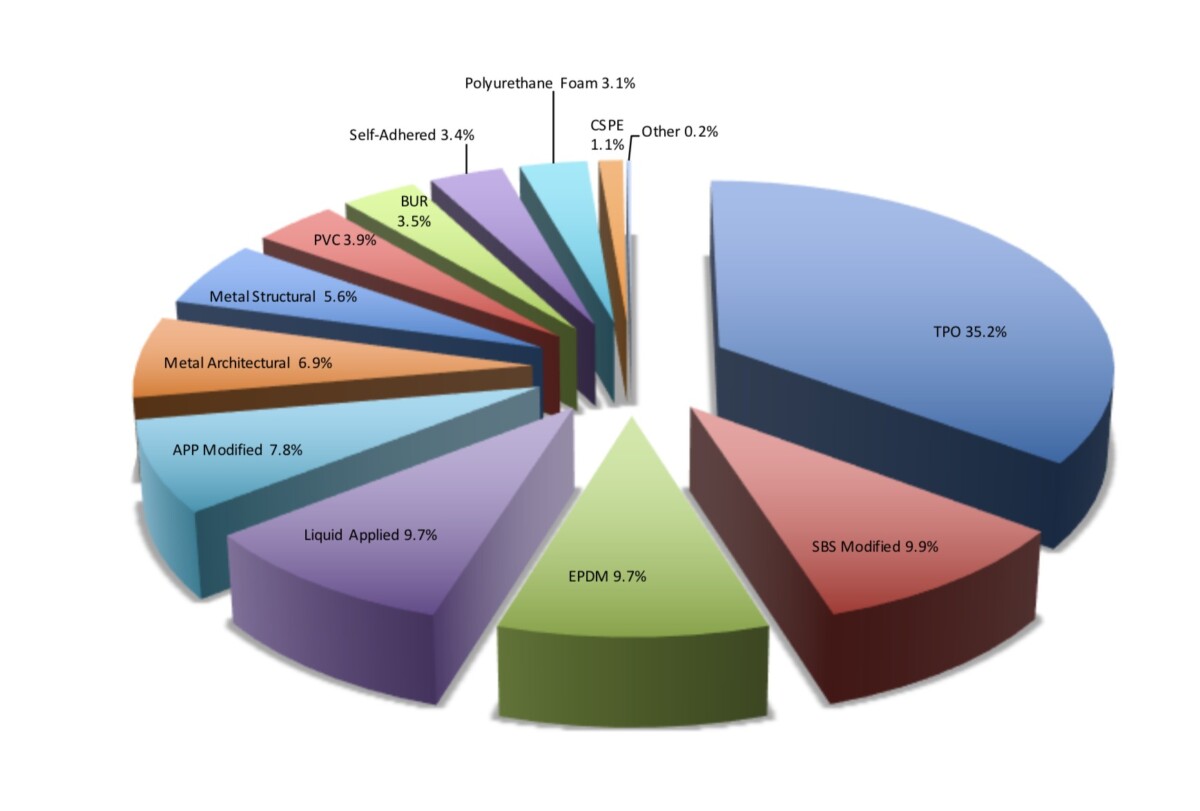

Western Product Mix

In the low-slope market, once again TPO will continue to take the biggest portion of the roofing pie in the West with a 35.2% share, up from the previous year. Metal roofing, both architectural and structural, also showed significant increases. Other materials remained steady with only minor fluctuations.

2022 Projected Western Commercial Market

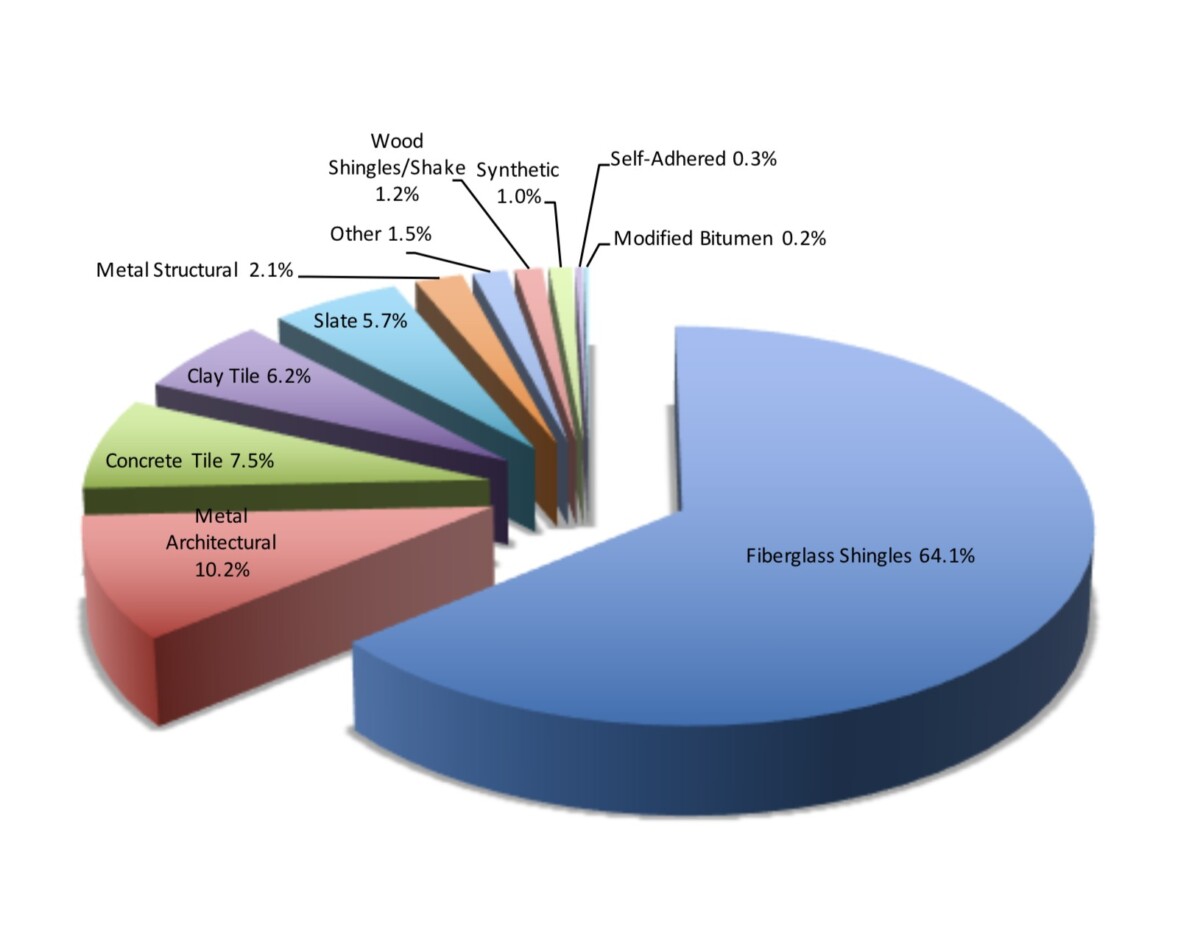

On the residential side, the top dog in the West for 2022 will once again be fiberglass shingles with a commanding 64.1% of the market. No surprise here, as it has become the product of choice for many reroofing applications. The majority of the sales are coming from high-end fiberglass/laminated shingles. Major manufacturers continue to emphasize their premium product lines, the bulk being applied on reroofing projects.

2022 Projected Western Residential Market

Minor increases were also seen in metal roofing materials. These market shares are based on dollar volume of the jobs as reported by contractors answering our surveys.

Down the Road

The last few years have not been kind to the construction industry. COVID-19 effects have been far-reaching. First, everyone was just trying to deal with the virus itself. Then came the aftermath, including trying to get people back to work, supply-chain shortages, rising prices, and now rising interest rates. What lies down the road for the remainder of this year? Many Western roofing contractors stated they are hoping for the best. Now it’s just a waiting game.