Low-Slope Roofing Market

Western Commercial Roofing Market Steadily Rising

by Marc Dodson, editor

Despite market hurdles such as rising inflation, higher interest rates, and more than enough vacant office space for rent, the commercial roofing market is on the rise in the West. According to various sources, demand for commercial and industrial roofing projects has been increasing steadily in the last half of this year.

But while demand may be increasing, some issues remain. While we still hear of the ever-present labor shortages, supply and material output is finally catching up with demand.

By all accounts, 2023 should finish up as a good year for the commercial roofing market. Of course, it may depend on your market as to just how big of an increase you may experience, but almost every roofing contractor involved with low-slope roofing in the West should see improvement.

Additionally, figures compiled from our own survey, plus information derived from several industry sources, indicate the same for commercial and industrial roofing construction in the Western half of the United States. The Associated General Contractors also noted an overall increase in construction projects nationwide. This upward material usage trend was mirrored in recent reports from ARMA and SPRI.

The low-slope roofing market will account for the major share of the total Western roofing market this year, with 55% of the total volume. While the dollar volume, as well as the number of squares applied is up, the percentage is down slightly from 56% last year. This is owing to the continued rise in the steep-slope market over the previous year.

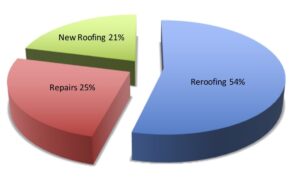

Reroofing, as usual, will continue to dominate the Western low-slope roofing market taking a predicted 54%, about the same as last year. Repairs and maintenance account for 25%, with new construction picking up the remaining 21%.

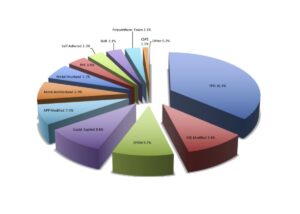

As for the popularity of commercial roofing products, we saw some changes again this year. All modifieds, including SBS, APP, and Self-Adhered, now account for 20.5% of the low-slope roofing market. All forms of single-plys, mainly TPO, EPDM, PVC, and CPE, have a combined share of 50.9%. Single-ply roofing materials now account for slightly over half of the commercial roofing market in the West. Amongst single-plys, TPO once again claimed the number one spot with a 36.3% market share, a slight increase from the 35.2% last year. SBS Modified takes the number two spot with 9.8%, about the same as last year.

Metal roofing products, both architectural and structural, saw a rise in their market shares over the past year. Liquid-applied products also continue to rise year after year.

Although nobody knows for sure what will happen next year, from all economic indicators, it looks like the national construction economy will continue to increase as building and facility owners spend some money to expand their businesses. The low-slope segment will again be leading the way, and the steady increase we saw during the last half of this year will hopefully continue.