Market Survey: Western Market Share

The Roofing Product Market in the West

by Marc Dodson, editor

Just when it looked like we might be out of the woods following the COVID-19 crisis, the economy starts to take a downturn. Luckily, the roofing industry is fairly constant, and people will always need to repair or replace the roof over their heads.

This confident attitude was confirmed in our annual reader survey. Roofing contractors are keeping busy. The complaints heard frequently were not enough skilled, or even unskilled labor, to handle the jobs available. The grumblings of last year concerning material shortages have all but disappeared as workload catches up with demand. Manufacturers have attested to this as production has been reduced as supply lines have been filled. Indeed, the roofing industry, and construction in general, is in a state of flux as businesses struggle to find the new norm.

Many former office workers are now performing their tasks remotely. Some are working 100% from home, some part-time remotely while part time in the office, and some have completely returned to office work. Besides leaving a glut of office space in its wake, this situation has affected many local supporting business as well, which I’ve highlighted in my editorial earlier in this issue.

This ongoing situation has had its ripple effect on the construction industry. While the overall sales of roofing materials have slowed, the percentages of the product mix are fairly close to what we’ve seen in recent years.

Steep-Slope & Low-Slope

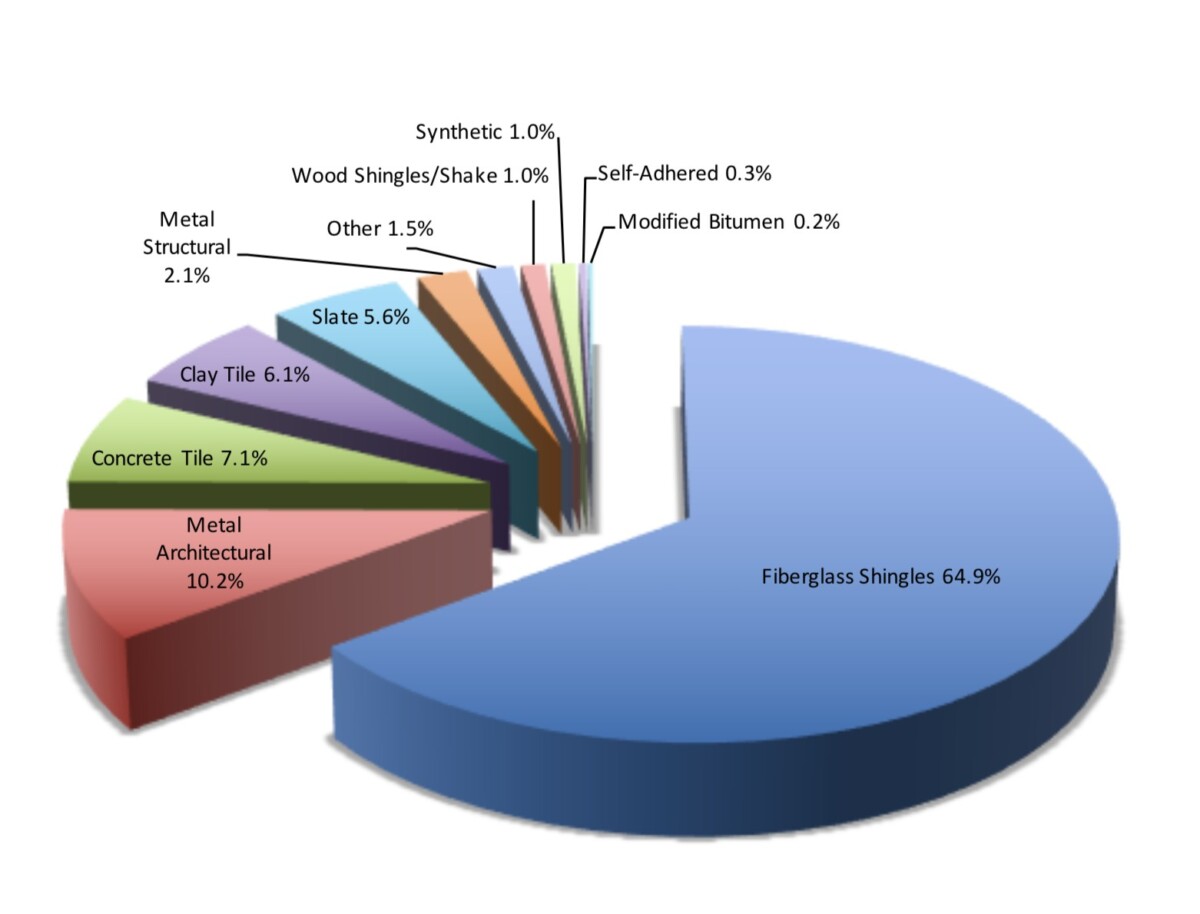

Reroofing will again make up the majority of the steep-slope market this year. While the resale of existing homes has stabilized, and prices have even gone down in many areas of the West, starts of new homes have been reduced dramatically. As a result, roofing materials traditionally used more for new construction, such as slate and tile, have lost market share. Reroofing materials, like fiberglass shingles, have increased.

New low-slope construction also slowed, and reroofing and recover will again account for the majority of growth this year. The low-slope market is expected to capture about 55% of the total this year with steep-slope taking about 45%, a slight increase for the steep-slope portion of the pie. Overall, the projected 2023 market is 21% for new construction, 54% reroofing, and 25% repairs and maintenance.

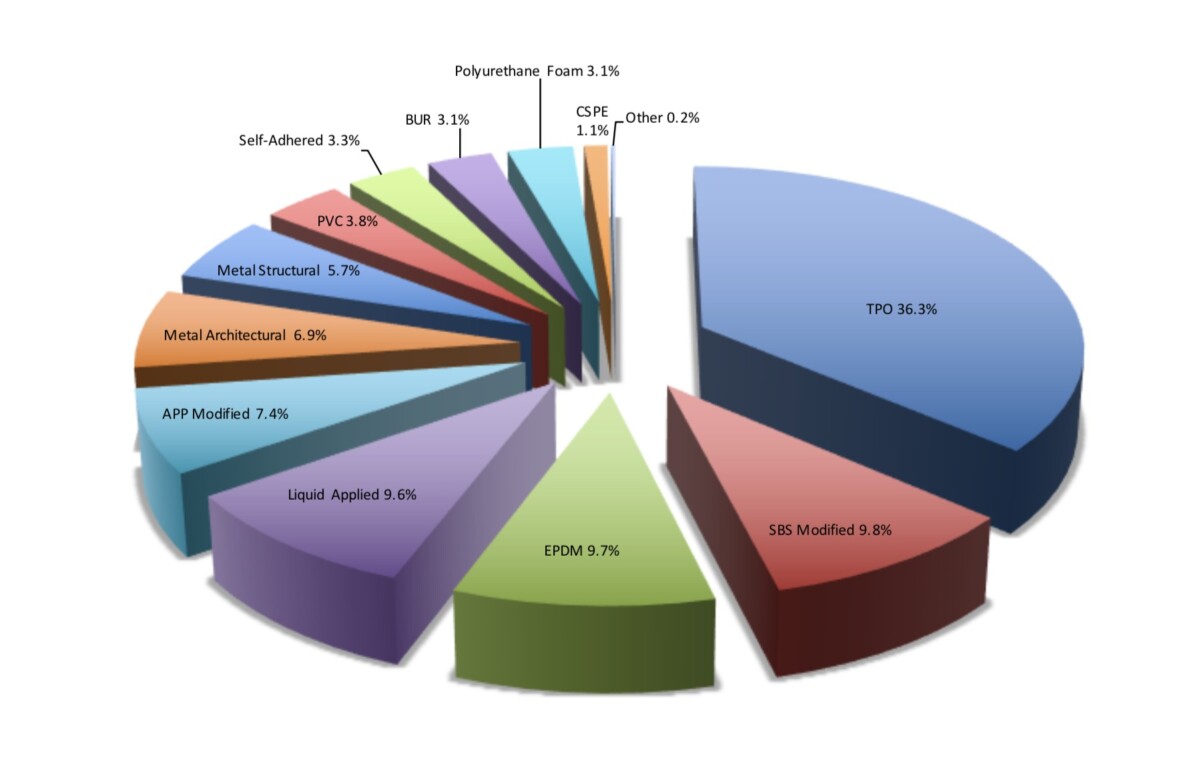

Western Product Mix

In the low-slope market, TPO continues to take the biggest cut of the roofing pie in the West with a 36.3% share, up again from the previous year. Metal roofing, both architectural and structural, also showed slight increases. Other materials remained steady with only minor fluctuations.

On the residential side, the top performer in the West for this year will once again be fiberglass shingles with a commanding 64.9% of the market. This figure is up from last year, as the majority of the sales of fiberglass/laminated shingles comes from the high-end and used on reroofing projects.

Slight increases were seen in other reroofing materials. The market shares are based on dollar volume of the jobs as reported by contractors answering our surveys.

The Road Ahead

What lies ahead for the remainder of this year? The pandemic may be on its way out, but the economy is reducing speed. Nevertheless, Western roofing contractors state they expect both the commercial and residential roofing markets to continue a slow but steady increase. As stated previously, one of the biggest obstacles for many Western roofing contractors is finding, and keeping, qualified roof mechanics to do the work. What the economic climate holds in the near future remains to be seen.