Market Survey: Commercial Roofing Market

Supply-Chain Issues Hamper the Western Low-Slope Roofing Market

by Marc Dodson, editor

First it was COVID-19, then construction projects slowed since people weren’t allowed work in close proximity to each other. That morphed into supply-chain issues, which brought about inflation. Now that the economy is slowing, we are seeing postponements of construction projects. It seems the roofing industry just can’t get a break.

However, it may not be as bad as it sounds. Manufacturers are still producing roofing products as fast as they can, when they can get the raw materials. Many roofing contractors we spoke with at the recent Western Roofing Expo in Las Vegas, Nevada, stated that they are as busy as ever. Most of those said they would be even busier if they could get their hands on more material, and it seems to be loosening up. As a result, commercial and industrial roofing projects has been increasing steadily in the last half of this year.

The low-slope roofing market will account for about 56% of the total Western roofing market this year. This percentage is down slightly from last year owing to the phenomenal rise in the steep-slope market over the previous year. People working from home and subsequently remodeling, adding a home office, or even a second home, accounted for the increase in the residential market last year.

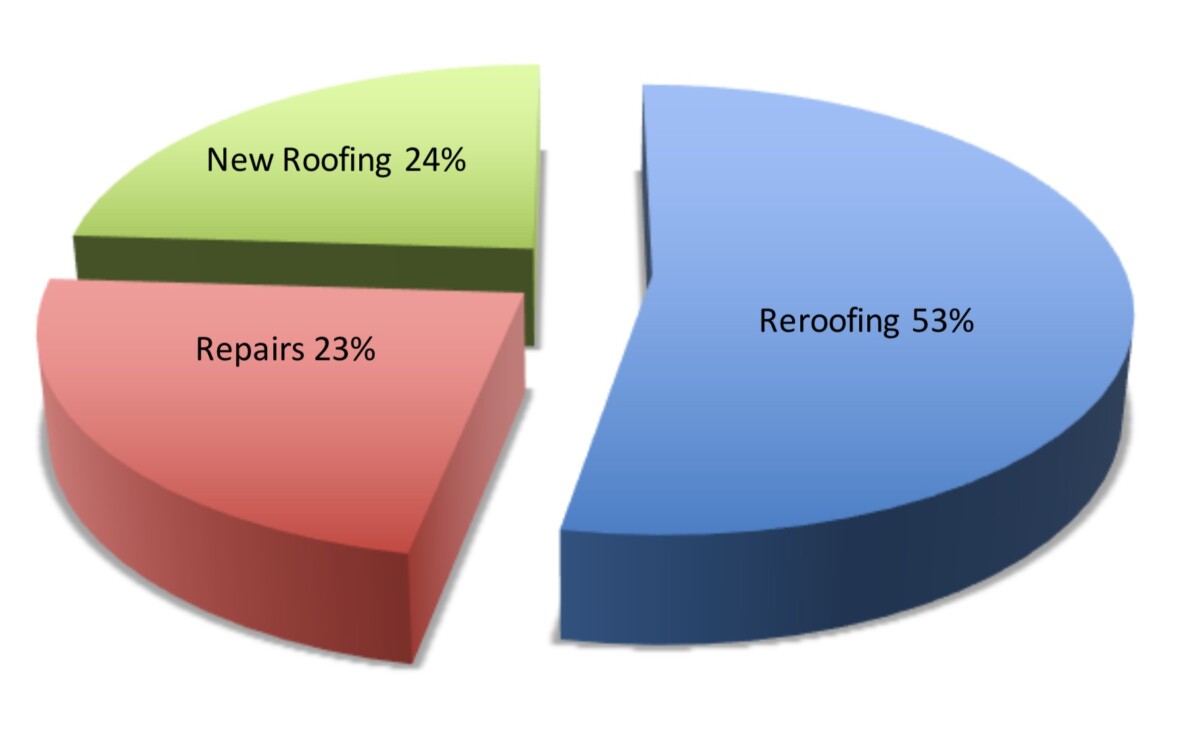

Figures compiled from our own survey, plus information derived from several industry sources, indicate that commercial and industrial roofing construction will remain stable in the Western half of the United States. The Associated General Contractors noted that overall construction will be down nationwide, but the West has been bucking that trend. Reroofing, as always, dominates the Western low-slope roofing market taking a predicted 53%, about the same as last year. Repairs and maintenance account for 23%, with new construction picking up the remaining 24%.

2022 Commercial Roofing

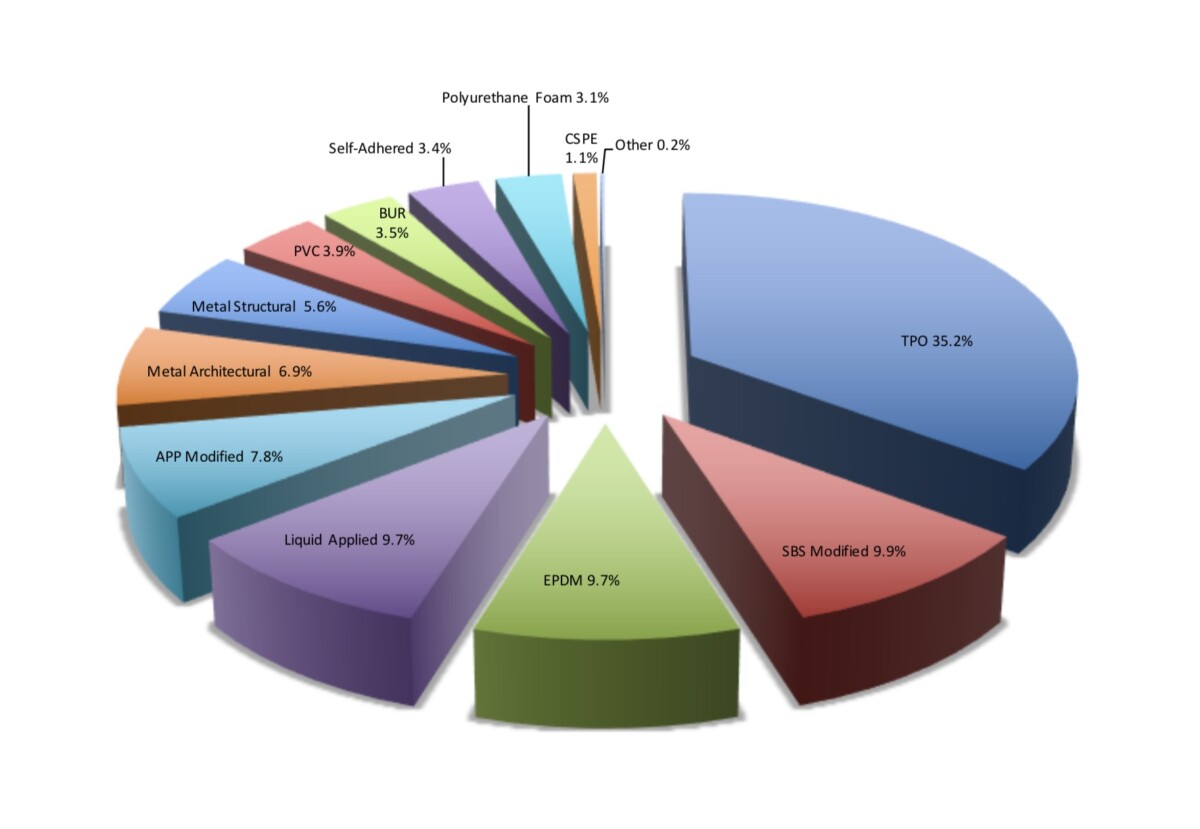

As far as the popularity of commercial roofing products, we saw some changes again this year. All modifieds, including SBS, APP, and self-adhered, now account for 21.1% of the low-slope roofing market. All forms of single-ply, including TPO, EPDM, PVC, and CPE, now have a combined share of 49.9%, or essentially half of the commercial roofing market in the West. Among single-ply options, TPO showed the biggest gains by once again claiming the number one spot with a 35.2% market share, an increase of 1.5% from last year. EPDM takes the number two spot with 9.7%, about the same as the previous year. Metal roofing products, both architectural and structural, also saw a rise in their market shares over the past year.

2022 Western Commercial Market

While nobody knows for sure what will happen next year, from all economic indicators, it looks like the national construction economy looks strong. Building and facility owners are willing to spend some money to expand their businesses. We’ll just have to wait see how long it takes to get the supply-chain issues resolved.