Market Survey: Residential Market

Western Steep-Slope Roofing Market Continues To Grow

by Marc Dodson, editor

With COVID-19 fears and restrictions easing and more people willing to go back to work, albeit not enough, the steep-slope market continues to be alive, well, and growing in the West. The fly in the ointment is that mortgage rates are on the rise again after an all-time low. While that fact may deter some people from improving their current home, buying a second home, or moving, the Western residential market is still on the upswing. The whys and wherefores don’t matter. What does matter is Western roofing contractors are still busy and trying to keep up with the demand.

From contractors throughout the West, we hear that they are expecting a sustained growth in both the new residential roofing and reroofing markets. New steep-slope construction projects around the West are being built and roofed. While there may be a few areas where construction is slower than others, we’re pretty much hearing the same report all around the West. Steep-slope construction projects are definitely on the rise.

The Market

Recent reports of prices on existing homes are still increasing, but at a slower rate. People are on the move, whether it’s into existing homes, new homes, or remodeling and reroofing their abodes. This activity has increased the demand for residential roofing significantly. The Western steep-slope market seems to be doing significantly better than the rest of the nation.

One of the main problems for roofing contractors has been getting material for jobs. Many manufacturers of steep-slope reroofing and recover products have told us that they are keeping busy. As COVID-19 restrictions ease and raw material pipelines open back up, production of roofing materials is finally increasing again. While this slight increase is still below the demand levels, it’s a step in the right direction.

This year the Western steep-slope market will probably account for about 49% of the roofing pie, a slight increase from last year. This opinion is expressed by a number of sources, including industry experts, construction industry associations, financial institutions, and our own surveys.

Residential Mix

Custom homes began their resurgence a few years ago and that trend continues. Custom homes and upscale tract homes are still on the rise. This is excellent news for contractors and manufacturers specializing in slate and tile.

The construction and sale of single-family homes has been growing, while work on multifamily residences has also increased as the baby boomer population ages and moves to smaller upscale condos

Reroofing & New Construction

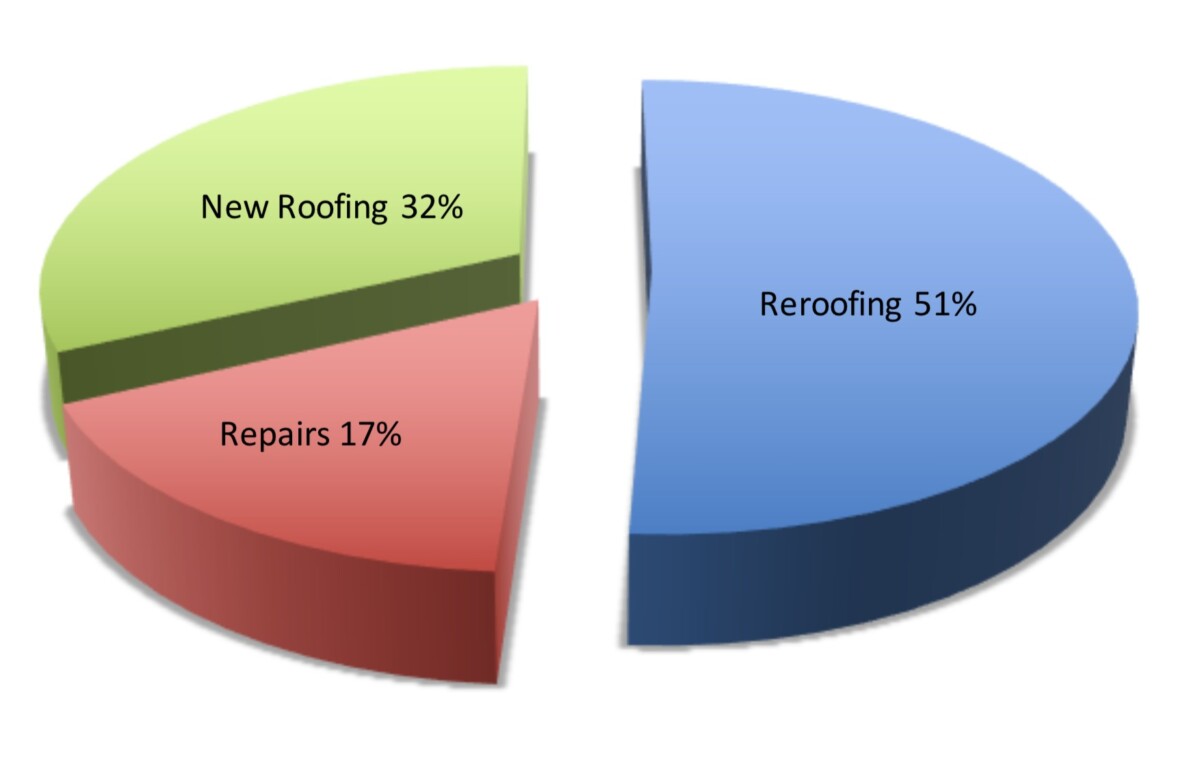

While reroofing continues to dominate the Western steep-slope market, this year new construction will take an increasingly larger share. Reroofing will capture a predicted 51% of the total Western residential volume. Repairs and maintenance will again account for 17%, the same as last year. The remaining 32% goes to new construction, up slightly from the previous year.

Product Mix

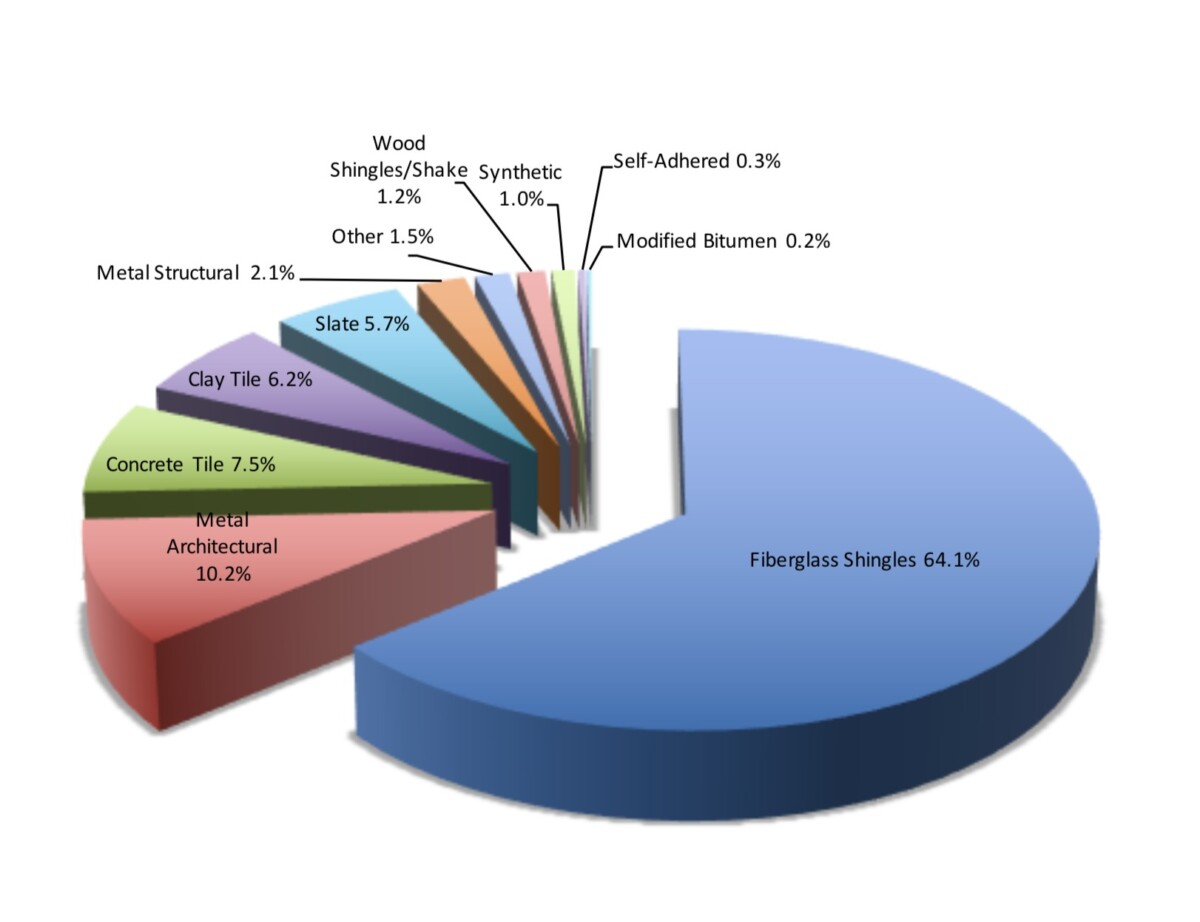

The most popular steep-slope roofing product installed in the West is, was, and remains, and probably will be for the foreseeable future, fiberglass shingles, with a whopping 64.1% of the market. This market percentage for fiberglass shingles is up slightly from last year. Not to be outdone, the Tile Council of Northern America recently reported that the American tile market, from both domestic manufacturing and imports, has risen to its highest level since 2017.

Down the Road

All this begs the big question; what lies ahead for the remainder of 2022 and beyond? There are many unknowns, including the upcoming elections, the continuing pandemic, the worldwide economic climate, and the ongoing quest to find enough willing bodies to work on the roof.

The construction industry is currently experiencing a steady upswing in both low-slope and steep-slope construction projects. The resale of existing homes is still on the increase, with many spending less time on the market and selling at higher prices than expected. While reroofing will always remain the dominant portion of the market, we’re seeing more and more new construction on the boards. The majority of industry sources seem to agree that this trend will continue for the immediate future.